Businesses across every industry have driven bitcoin’s bull market over the past year.

Our latest research reveals new insights into how widespread this trend has become, the rate of bitcoin adoption, and what’s driving businesses to embrace bitcoin.

Executive Summary

Or continue reading…

The groundwork for business adoption was laid in 2024

Bitcoin adoption in the private sector has reached unprecedented levels in 2025. This report explores how widespread this trend has become, its growth rate, and what is driving businesses to embrace bitcoin.

To understand why business bitcoin adoption is taking off, it helps to look back at the groundwork laid in 2024. We examined bitcoin’s growing role in the private sector in our 2024 report. For readers looking to understand the basics of bitcoin in a business context, we recommend starting with this earlier publication.

At the time, we described 2024 as a potential “liftoff year” for business bitcoin adoption, a prediction that has since proven accurate. Throughout the year, improvements in bitcoin’s accounting standards, regulatory clarity, institutional acceptance, and a strong bull market have created the ideal conditions for the widespread adoption we are witnessing today.

As a result, businesses have emerged as the primary force behind bitcoin’s ongoing bull market. In the first eight months of 2025, bitcoin inflows onto business balance sheets have already exceeded the total for all of 2024 by $12.5 billion.

Today, businesses collectively hold over 6% of the total bitcoin supply, a twenty-one-fold increase since January 2020.

Bitcoin Treasury Companies are a large driver of growth in business adoption, accounting for 76% of all business purchases since January 2024 and 60% of publicly reported business holdings.

The main purpose of these publicly traded firms is to accumulate large amounts of bitcoin, while offering investors who can’t directly buy bitcoin an option to gain price exposure through buying their stock.

While bitcoin treasury companies have captured most of the media spotlight, what is often overlooked is adoption by conventional businesses that use bitcoin to complement their existing business models. These include public and private companies across every sector of the economy.

There are less than 100 bitcoin treasury companies of meaningful size (10+ BTC in holdings). In contrast, River serves more than 3,000 business clients in the United States.

In this report, we provide a clear understanding of the breadth and scale of this rapidly growing trend across businesses of all sizes and sectors. If you want to learn the basics of bitcoin’s role for businesses, we invite you to start with our September 2024 report.

Bitcoin treasury companies in 2025

As a group, bitcoin treasury companies are the second largest buyers of bitcoin in 2025, acquiring roughly 1,400 BTC per day. These purchases are fueled by strong investor demand for the stocks, bonds, and other securities issued by these firms.

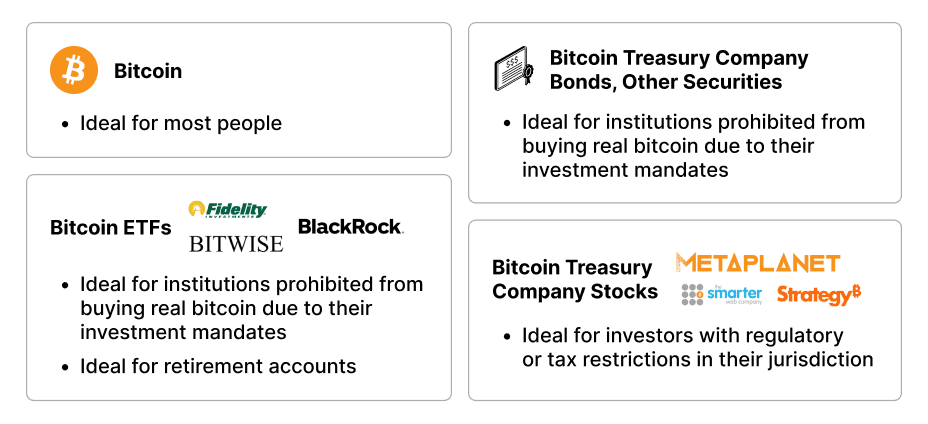

Why investors buy stocks in bitcoin treasury companies

As of August 2025, investors hold over $100 billion worth of stock in bitcoin treasury companies. These investors choose to buy these stocks instead of, or alongside, holding actual bitcoin in the following situations:

When direct investment in bitcoin is difficult

Regulatory barriers in certain countries make direct investment in bitcoin difficult or costly for investors:

- In regions where spot bitcoin ETFs or similarly regulated funds are unavailable, like the United Kingdom, bitcoin treasury companies provide a practical way for investors to gain price exposure.

- In Japan, high capital gains taxes on direct bitcoin holdings discourage individual investment, while taxes on stocks are comparatively lower. For many Japanese investors, buying shares in a bitcoin treasury company offers a more cost-effective and accessible way to benefit from bitcoin’s price movements.

When direct investment in bitcoin is restricted

Institutional constraints make direct bitcoin ownership difficult for many large investors.

Even when institutions view bitcoin favorably, their investment mandates often limit them to specific asset classes, preventing direct ownership. This is typically due to strict liquidity, valuation, and investor-protection rules and regulations that make owning bitcoin operationally impractical. In this context, bitcoin treasury companies offer a compliant way for these investors to gain indirect exposure to bitcoin’s price while staying within regulatory and policy boundaries.

For example, a fund restricted to bonds cannot buy bitcoin outright. However, it can invest in the corporate bonds issued by a bitcoin treasury company, effectively taking a bullish position on bitcoin.

Retirement funds, which typically have lower risk tolerances and avoid volatile assets like bitcoin or tech stocks, may still invest in the bonds or preferred shares of bitcoin treasury companies. This approach allows them to benefit from bitcoin’s potential upside while reducing volatility and staying within their investment guidelines.

When investors want leveraged bitcoin exposure

Some investors with higher risk tolerances seek leveraged exposure to bitcoin.

This usually involves borrowing money to amplify returns, but for individuals this often comes with high interest rates and strict collateral requirements, making leverage both expensive and risky.

Bitcoin treasury companies typically have access to capital at far lower costs. By borrowing at favorable rates, they can use leverage more efficiently. Investors who buy shares in these companies gain indirect access to that leverage, allowing for the potential of amplified returns without personally taking on debt. While this strategy still involves meaningful risk, it provides a simpler and often more cost-effective way to pursue leveraged exposure.

The amount of leverage and associated borrowing costs can vary widely between bitcoin treasury companies. As a result, investors often favor more established firms with proven track records.

The rise of bitcoin treasury companies

Michael Saylor pioneered the concept of a bitcoin treasury company when MicroStrategy (now Strategy) made its first bitcoin purchase of $250 million in August 2020. Today, Strategy’s bitcoin holdings are valued at over $70 billion. The company’s success has spawned the creation of more than 50 similar bitcoin treasury companies.

Some of these companies fill the exact niches we previously covered, such as Metaplanet, which is focused on the Japanese market. In the United Kingdom, several companies have emerged to fill the absence of a bitcoin ETF.

Currently, bitcoin treasury companies account for one-fourth of all public companies with bitcoin holdings, yet they only capture a small part of the adoption trend by businesses.

Bitcoin is for every business

Before 2024, business bitcoin adoption was relegated to a few niche areas of the private sector. Bitcoin miners were the earliest adopters, followed by crypto companies and a handful of unconventional players, such as Tesla, from other industries.

This has all changed as of 2024. River’s own data shows that Bitcoin now provides value for businesses of all sizes and sectors. In this section, we share insights drawn from the 3,000 businesses we serve.

Industry breakdown of businesses on River

Businesses of all sizes, from practically every sector of the economy, are now holding bitcoin in their treasuries.

While bitcoin adoption is not concentrated in any single industry, certain types of businesses are more likely to adopt early. These businesses often share one or more of the following traits:

- Small size: Small and medium-sized businesses tend to be more agile, but they are also more vulnerable during economic downturns. With limited access to capital in tough conditions, they often maintain proportionally larger treasury reserves. This has made them early adopters of bitcoin. Notably, 75% of businesses using River have fewer than 50 employees.

- Concentrated ownership: Companies with a small number of decision makers face fewer internal hurdles, allowing them to move more quickly. When leadership personally understands the value of bitcoin, they are more likely to champion its use as a business asset.

- Long-term oriented: Bitcoin tends to appeal to businesses that take a long-term view of their treasury strategy. This includes capital-intensive industries like real estate, as well as startups with extended paths to profitability. These companies often hold reserves for long periods to manage uncertainty while awaiting future returns.

The map below offers a more detailed view of the industries, and businesses within them, that have adopted bitcoin through River. Box sizes reflect the number of business clients within each industry.

Bitcoin has emerged as a preferred way to retain earnings

Bitcoin has become a trusted way for businesses across the economic spectrum to retain earnings, thanks to its unique combination of scarcity and liquidity.

Today, many businesses face challenges in deciding how to allocate income. Traditional approaches, such as reinvesting in growth or returning capital to shareholders, work well during strong economic periods when profits are rising. But in times of uncertainty, these strategies can increase risk by weakening the balance sheet.

In uncertain environments, companies often shift their focus to strengthening their financial position. Dividend-paying firms may reduce shareholder payouts, while highly leveraged businesses may prioritize debt repayment. For companies without such obligations, the most effective way to build financial resilience is by holding assets that preserve long-term value. In this context, bitcoin has emerged as a preferred way to retain earnings.

Why are businesses choosing bitcoin over other assets?

- Inflation resistance: Bitcoin’s fixed supply offers businesses a way to preserve value over time and hedge against inflation, something traditional currencies and many fiat-denominated assets struggle to do.

- Enhanced liquidity: Unlike traditional banking systems, which operate within limited hours, bitcoin is accessible 24/7. This always on liquidity makes it a powerful emergency fund, allowing businesses to move funds instantly even during weekends, holidays, or banking disruptions.

- Counterparty risk protection: The 2023 Silicon Valley Bank collapse highlighted the counterparty risk of the traditional banking system. Businesses suddenly lost access to their funds, leaving them unable to pay bills or meet payroll. Bitcoin offers an alternative: businesses can self-custody their assets, reducing dependence on third parties and avoiding this kind of systemic risk.

- Securities laws: Businesses are not hedge funds, and generally avoid investment securities like stocks and private equity. Current regulations also prevent most businesses from holding a large portion of their assets in investment securities. Bitcoin is a commodity, not a security, meaning businesses have no limitations on bitcoin investments.

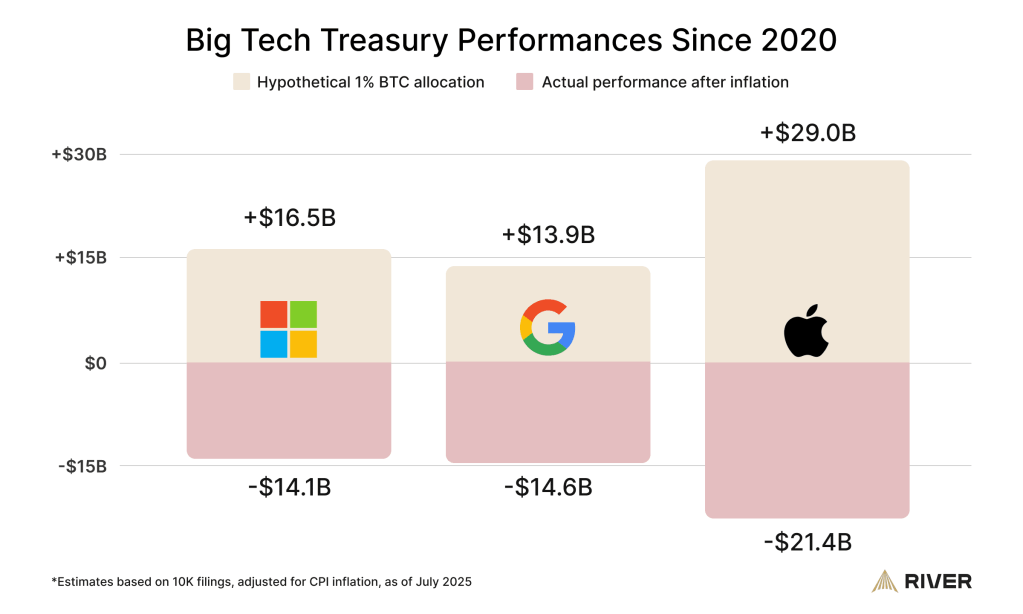

- Inadequacy of conventional assets: Traditional treasury assets such as government bonds and money-market funds have failed to adequately preserve value in the face of inflation. Since 2020, major companies such as Microsoft, Google, and Apple have lost tens of billions in purchasing power by holding these traditional instruments. Had they allocated even 1% of their treasuries to bitcoin in 2020, those losses would have been fully offset.

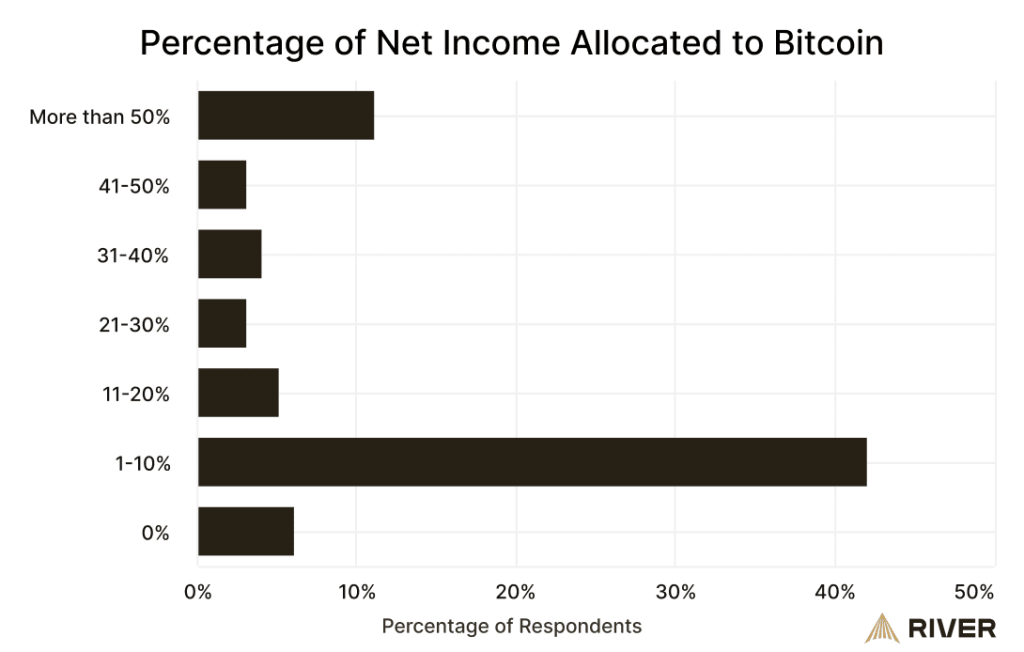

River’s data shows that many businesses are allocating far more than a hypothetical 1% to bitcoin. Businesses using River allocate an average of 22% of their net income, according to a July 2025 survey. The median allocation is 10%.

63.6% of these businesses view bitcoin as a long-term investment, steadily accumulating without plans to sell or rebalance in the foreseeable future.

Because bitcoin has historically appreciated over time, nearly one-third of River’s business clients now hold the majority of their treasury assets in bitcoin, even if they began with only small allocations.

Businesses value self-custody

Bitcoin is unique among treasury assets in its ability to reduce counterparty risk to banks and other third parties when held in self-custody. According to our data, roughly one-quarter of businesses self-custody at least a portion of their bitcoin, though approaches vary.

Only 7.6% of businesses fully self-custody their bitcoin holdings. Most choose a hybrid approach, storing some assets with exchanges or custodians while keeping a portion in self-custody.

How bitcoin goes mainstream for businesses

We believe that bitcoin will emerge as a global reserve asset, while US dollars will continue to be used as a transactional currency in the foreseeable future. In this future, every individual will have bitcoin savings, and every business will have bitcoin on its balance sheet. But what will it take to reach that future, and what could it look like?

Bitcoin is already in the process of becoming a mainstream asset, as evidenced by the meaningful acceleration in adoption since early 2024:

Business adoption is now largely unconstrained

Today, there are practically no hard barriers preventing businesses from adopting bitcoin in the US:

- The protocol: At the most foundational level, the Bitcoin protocol is extremely reliable, with zero downtime in the past decade. Following the 2024 halving, bitcoin’s supply growth rate has dropped below that of any other investable commodity.

- Regulatory: Concerns that governments would “ban” bitcoin or restrict corporate ownership have largely dissipated. Several nation-states now openly invest in bitcoin, and in March 2025, the United States established a Strategic Bitcoin Reserve.

- Accounting treatment: Until recently, unclear tax and accounting guidelines were among the most common reasons businesses avoided bitcoin, cited by 78% of respondents in a River survey. But in 2024, GAAP standards were updated to reflect a more accurate and business-friendly approach to bitcoin accounting. You can read more about these updates in our article: Bitcoin Accounting and Taxes for Businesses.

- Liquidity: Historically, bitcoin lacked the liquidity required for large-scale business adoption. That’s no longer the case. Today, bitcoin ranks among the most liquid assets globally and trades 24/7, unlike most traditional treasury assets. The emergence of ETFs, futures markets, and structured financial products now allow businesses to customize their exposure based on operational needs and risk tolerance.

- Volatility: Bitcoin’s volatility has steadily declined over time, now similar to that of gold and many stocks. Many still view bitcoin’s volatility as a disqualifying factor, and will continue to operate under that past perception for some time. However, businesses that scale their allocations to match their risk appetite have no need for concern.

These advancements now mean that most businesses can already add bitcoin to their treasuries in a secure and compliant way. However, less than 1% of businesses have done so. What explains the difference?

What could drive further business adoption

In the absence of technical or regulatory barriers, the biggest obstacle to business adoption of bitcoin is public perception.

Most businesses are not even considering bitcoin as a treasury asset, largely due to widespread misunderstandings and limited awareness. The data reflect this gap:

- Only 6% of Americans are aware that bitcoin’s supply is capped at 21 million, according to a survey by Cornell University.

- 46% of businesses cited a “lack of understanding” as a major barrier to adopting cryptocurrency, according to a 2025 GoodFirms survey.

- While nearly 95% of Americans have heard of bitcoin, 60% admit they “don’t know much” about it, according to a 2025 Gallup Poll.

In other words, bitcoin is often dismissed not because it has been evaluated and rejected, but because most decision-makers don’t have the understanding to evaluate it in the first place.

Among the minority of businesses that do consider bitcoin, most don’t follow through because it goes against established norms.

In traditional corporate environments, decisions are made by committees, boards, and executives who are heavily incentivized to follow norms and avoid controversy. Even if a CEO or CFO is personally convinced of bitcoin’s long-term value, they are unlikely to advocate for adoption unless peer companies have already done so.

The perceived cost of being “wrong early” often outweighs the potential reward of being “right first.” This risk-aversion is especially pronounced in large, publicly traded firms, where any contrarian stance invites scrutiny from boards, shareholders, and the media. This explains why so few companies in the S&P 500 and Fortune 500 hold bitcoin.

Unlike intellectual property or trade secrets, investing in bitcoin is not a strategy companies need to keep secret. Instead, many are intentionally transparent about their treasury strategies, encouraging other businesses to learn from their example.

- Block, the company behind CashApp and Square, open-sourced their blueprint for bitcoin on corporate balance sheets.

- Strategy (formerly MicroStrategy) has a webpage devoted to helping businesses navigate bitcoin strategies.

This transparency is core to Bitcoin’s ethos, and is what will ultimately drive further business adoption over time. Reports like this one build on that openness to reduce bitcoin’s perceived reputational risk and make it a standard asset on business balance sheets.

Fortunately, public perception of bitcoin is already steadily improving. According to the Nakamoto Project, the number of American adults who own bitcoin increased by an estimated 11 million people between early 2024 and March 2025. The number of US adults who describe bitcoin as “trustworthy” rose from 5.3% to 10.2% in 2024, according to the Harris Poll.

In recent years, influential figures, including the Federal Reserve Chairman, the CEO of BlackRock, and even the sitting president, have shifted their stance on bitcoin. At the same time, more businesses are adding bitcoin to their balance sheets each year. Every new adopter helps lower the barrier to entry for others, creating a reinforcing cycle of adoption.

The process of buying and managing bitcoin as a business is also becoming significantly easier. While most traditional banks and financial institutions still don’t offer bitcoin services for businesses, a growing number of companies are emerging to fill the gap.

Conclusion

Bitcoin is already delivering value to businesses across every sector of the economy, but overall adoption remains in the early stages. In the future, we believe that every business will hold bitcoin on their balance sheet, while continuing to spend in dollars for the time being. As we enter this Dual Money Era, businesses will demand frictionless movement between bitcoin and US dollars. While US dollars will remain the primary currency for payroll, expenses, and revenue, bitcoin will increasingly become a dominant asset for long-term savings. River is proud to serve our business clients as they transition to this future.

River’s business services

River is the premier Bitcoin platform for businesses, trusted by thousands of corporations, trusts, non-profits, and more:

Visit River.com/business to get started.

Disclaimer

This report was prepared for informational purposes only and does not represent investment advice of any kind. River Financial Inc. does not provide tax, legal, investment, or accounting advice, and this report should not be relied on or construed as such. We recommend performing your own analysis and seeking professional advice before making any financial decisions.

Information contained in the report is based on either our own data or external sources we consider to be reliable. We cannot guarantee the accuracy or completeness of all data.

River Financial Inc. shall have no liability whatsoever for any actions taken or decisions made as a consequence of the information in this report, including any expenses, losses, or damages, whether direct or indirect. The contents of this report are the property of River Financial Inc. and may not be duplicated or distributed without the prior written consent of River Financial Inc.

You must be logged in to post a comment.