This newsletter explores bitcoin’s recent price decline and how you can be prepared for what comes next.

Why is bitcoin’s price down?

It’s been 50 days since bitcoin reached its all-time high of over $126,000 on October 6th. Since then, the price has dropped more than 30%, while stocks and gold have remained relatively stable. Does this mean we’re in the beginning of a bear market?

Despite what headlines might suggest, bitcoin’s pullback can’t be attributed to any single cause. We’re observing four key themes:

1. Price declines are normal in bull markets

In previous bull markets, price declines of 25-50% were quite common, as shown in the chart below. Bitcoin’s current bull market has been unusually stable, making the current price decline feel more daunting.

2. ETFs and Bitcoin Treasury Companies have stepped back

Exchange-traded funds (ETFs) and bitcoin treasury companies have accumulated more than 1 million bitcoin since the beginning of 2024, making them the largest buyers of bitcoin during this bull market. Recently, these buyers have paused their purchases.

In the past 30 days, ETF holders have sold more than 44,000 BTC or $4.2 billion, putting meaningful downward pressure on bitcoin’s price. Additionally, Strategy (formerly MicroStrategy), which owns more than 640,000 BTC, hasn’t made significant recent purchases and now risks being removed from large indices.

3. Investors with leverage have been forced to sell

Much of bitcoin’s price decline has been driven by forced sellers, or highly-leveraged investors who have been liquidated from their positions.

As an example, October 10th marked bitcoin’s largest single-day price decline of over $10,000. This was caused by more than $2.4 billion being sold across exchanges that offer leverage. Since then, there have been multiple days with similar levels of liquidations.

The removal of leverage makes bitcoin less vulnerable to sharp price declines and creates a healthier environment for a continued bull market.

4. Bitcoin isn’t the “hot trade” right now

Many investors are drawn to whatever has gone up the fastest in recent months. In previous bull markets, bitcoin’s sharp price increases drew many such investors seeking quick gains. Today, the hot trade isn’t bitcoin, but rather AI and quantum computing stocks. Investors seeking quick gains have sold their bitcoin in hopes of better returns elsewhere. This includes long-term bitcoin holders, who in aggregate have been large sellers since July.

This isn’t a bad thing. As bitcoin matures, it’s attracting a new class of investors with a longer-term mindset.

Should you be worried?

While it’s possible that this is the beginning of a more prolonged bear market, nothing about bitcoin’s fundamentals has changed:

- Bitcoin remains the most reliable and incorruptible network in the world.

- It is also becoming more scarce every day, as less than 5% of bitcoin’s supply of 21 million are left to be mined.

The Federal Reserve is poised to begin money printing again next year, while the U.S. Federal debt just surpassed $38 trillion, making the case for bitcoin stronger than ever.

This points to a continuation of what’s been happening for decades: While your dollars are eroding away in value, more and more people are waking up to the value of a scarce and incorruptible form of money.

What you can do about it

The most important thing with bitcoin investing is to be responsible:

- Don’t invest more than you can afford to lose.

- Avoid speculating on bitcoin’s price in the short term.

- Keep a long-term mindset.

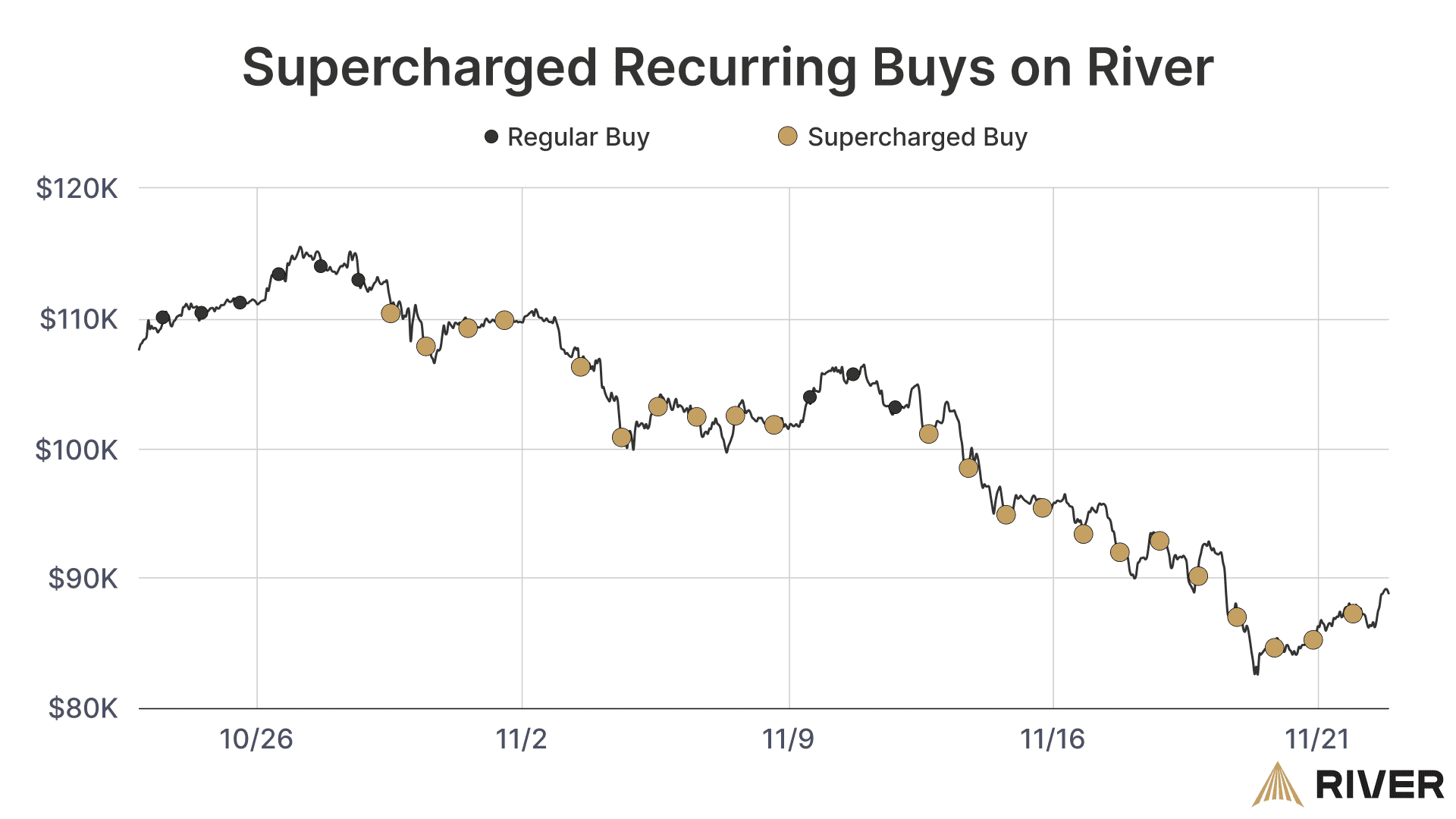

River makes it easy to accumulate bitcoin for the long-term. In addition to zero-fees on recurring buys, you can now Supercharge your recurring buys, meaning you’ll stack more bitcoin when the price dips.

Hopefully this newsletter gave you some insight to focus on the bigger picture in case anyone asks about bitcoin during Thanksgiving. You could also not talk about it and enjoy time with family. Bitcoin will still be there next week!

You must be logged in to post a comment.