Stay up to date on Bitcoin

through River’s newsletter

-

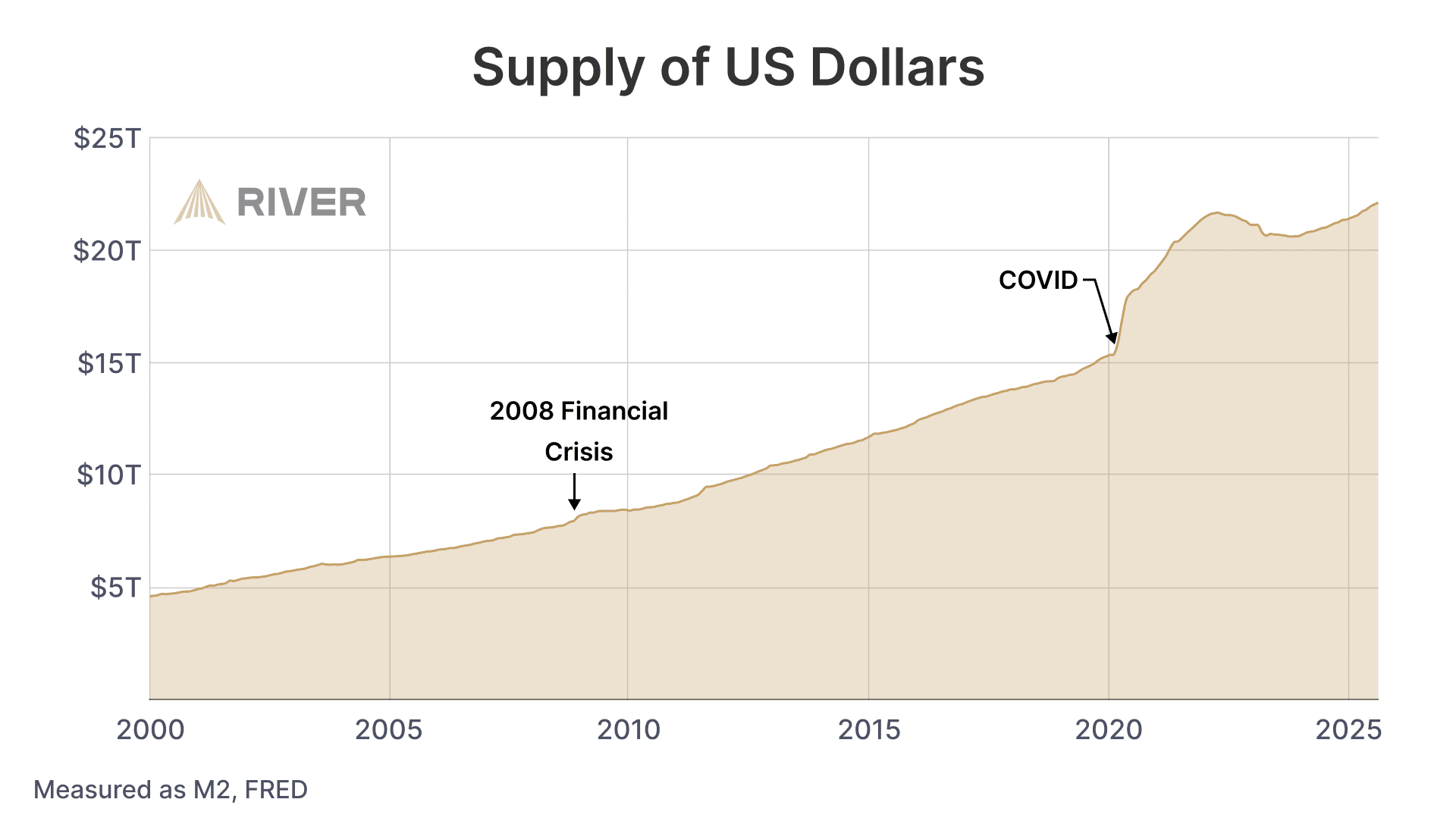

Re-entering an era of easy money

What fed cuts mean for bitcoin, and what they reveal about our broken money system

-

Is Bitcoin’s Bull Market Just Getting Started?

This newsletter takes a deeper look into what’s driving this price rally so far.

-

Bitcoin to Support Mortgages

This newsletter covers an important regulatory change to the mortgage industry and where this fits in the big picture for Bitcoin.

-

Is Bitcoin Becoming a Safe Haven?

This newsletter covers bitcoin’s outperformance in periods of market uncertainty and recent updates from River.

-

Thousands of Businesses Are Holding Bitcoin

A deeper look into business bitcoin adoption at the grassroots level, and how bitcoin stacks up against global money.

-

The Top 21 Bitcoin Holders: 2024 Edition

River’s inaugural Top 21 List reveals the world’s richest Bitcoin holders, who collectively own 2.3 million BTC worth over $217 billion.

-

How To Make Friends and Family Listen to You About Bitcoin

Struggling to explain Bitcoin to others? River’s latest guide and Bitcoin 2024 talk share practical tips to improve your Bitcoin education skills.

-

What’s Happening to the Bitcoin Price?

Bitcoin dropped amid a global market selloff—but River clients are buying the dip. Learn why bitcoin’s fundamentals remain unchanged.

-

7 Ways to Earn Bitcoin

River’s latest newsletter explores how to earn bitcoin productively, without becoming a full-time investor.

-

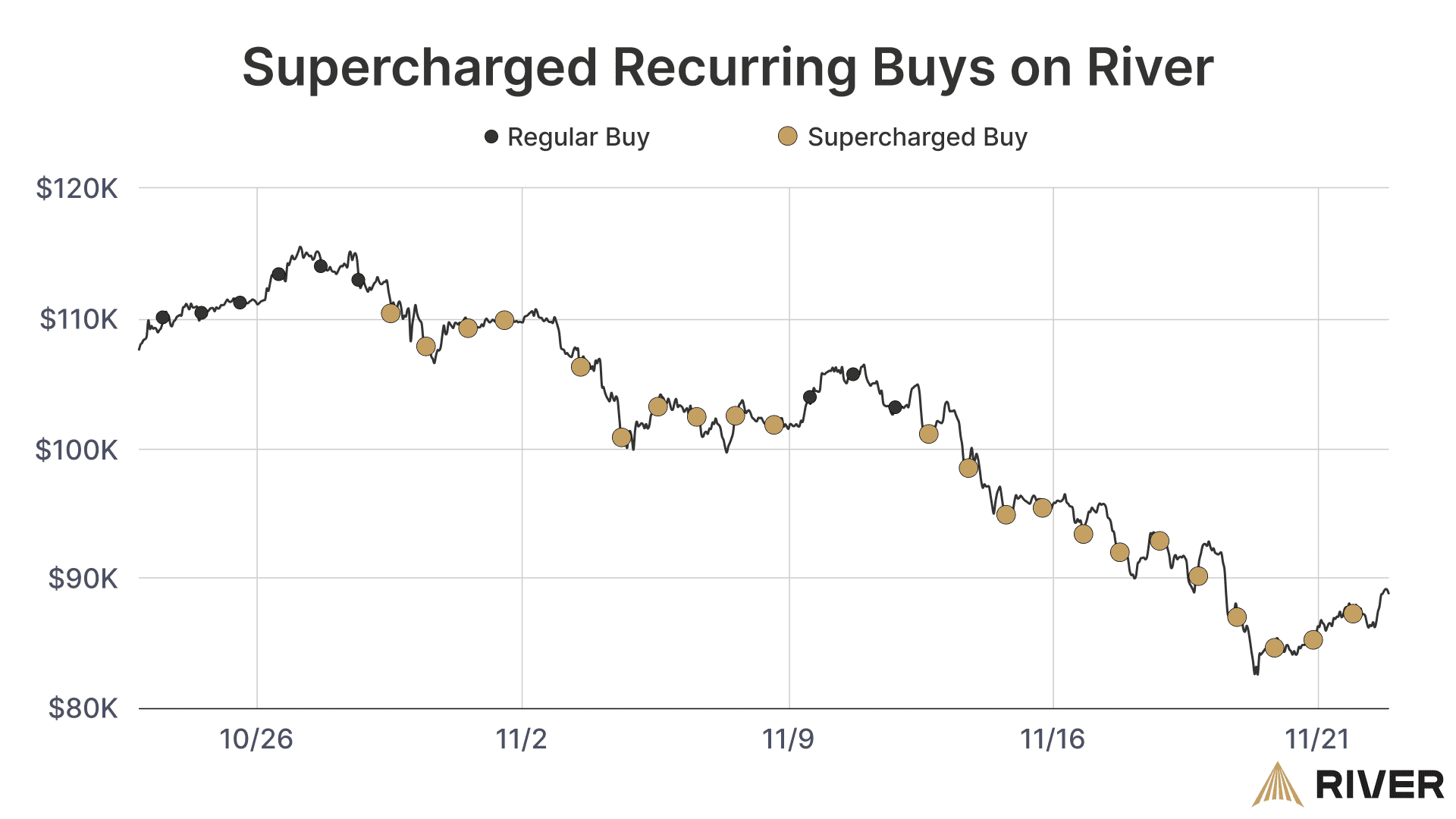

What’s Going On With Bitcoin’s Price?

Bitcoin is just 10% below all-time highs. River breaks down what’s holding it back—and why the long-term outlook remains strong.

-

52% of Top US Hedge Funds Own Bitcoin ETFs

Institutional bitcoin demand is surging. River tracks this shift and why owning real bitcoin still matters more than ever.

-

Bitcoin’s 5th Epoch Is Here

Bitcoin enters its 5th epoch post-halving. River breaks down who mined it, explains the Cantillon Effect, and shares what’s next for platform upgrades.

-

Bitcoin’s Quadrennial Halving Is Coming!

Bitcoin’s 4th halving is set for April 20, 2024. Learn what it means, how it may impact price, and why it’s a milestone worth celebrating.

-

ETFs -> 9.64% of Bitcoin Supply

Bitcoin’s bull market is here. ETFs may soon hold nearly 10% of supply. River sees record growth as new Bitcoiners and referrals surge.

-

Daily Bitcoin Demand = 2.6x New Supply

Bitcoin ETFs now hold 3.9% of supply and are buying faster than new coins are mined. Learn more on ownership, scaling, and the impact of…

-

Do You Make This Mistake When You Self-Custody?

Bitcoin ETF inflows offset GBTC outflows, but price lags. River explains why, and shares tips on smarter self-custody and Lightning growth.

-

Spot Bitcoin ETFs Approved! Now What?

Spot Bitcoin ETFs are live. River explains their impact, compares ETF fees to owning bitcoin directly, and shares a look back at a big 2023.

You must be logged in to post a comment.