This newsletter examines the coming wave of money printing, its impact on bitcoin, and what it reveals about the deeper flaws in today’s financial system.

Everything is about to go up

Two weeks ago the Federal Reserve cut interest rates and signaled that money printing will increase in the near future. This means the prices of nearly everything will rise. From groceries, to stocks, to bitcoin.

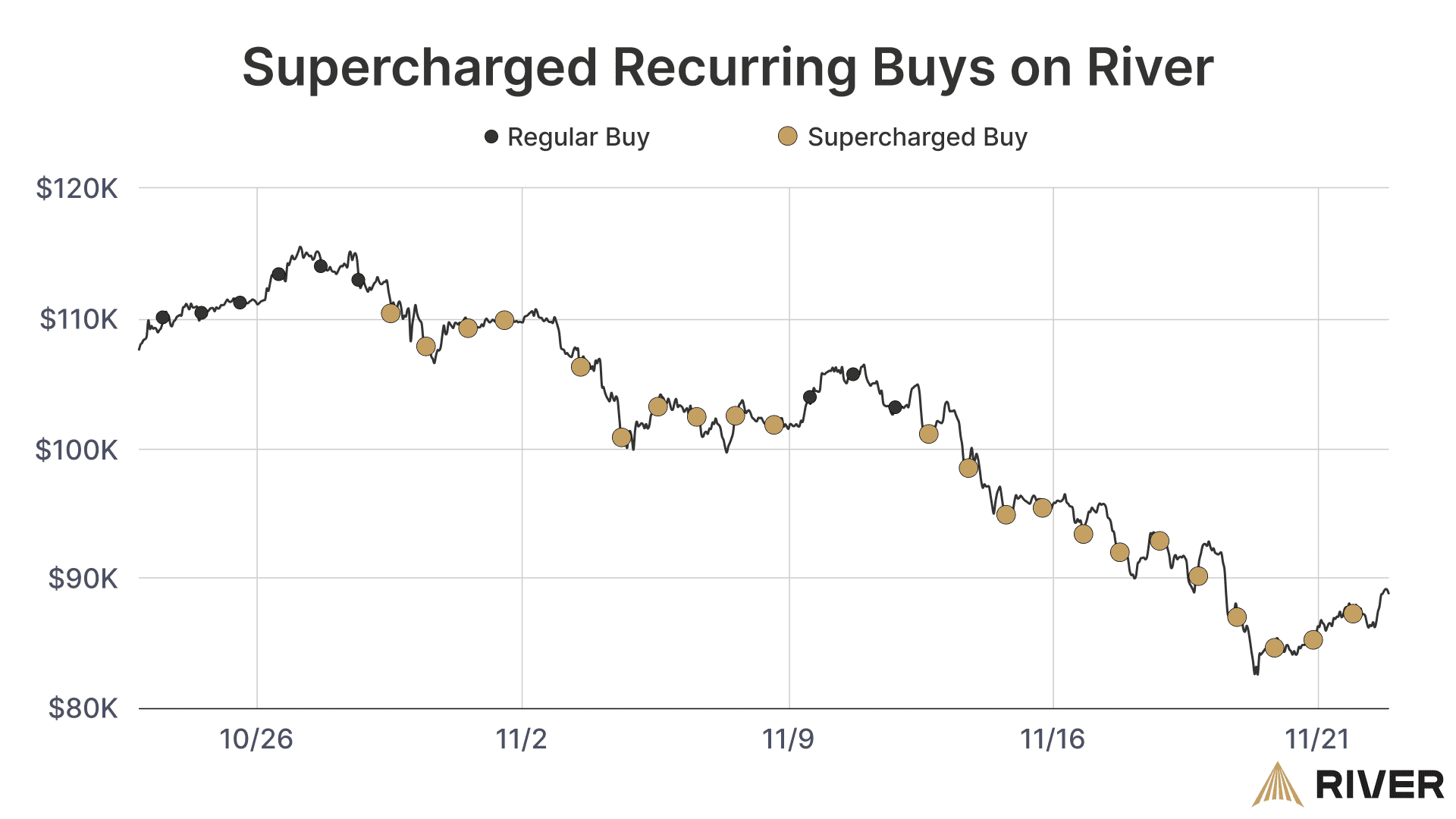

Below you can see how bitcoin has historically reacted to these periods of money supply expansion.

The Fed’s recent and upcoming rate cuts are not a guarantee of continued strong performance for bitcoin. Afterall, bitcoin tends to do what people least expect. Still, it is likely that we are entering a period of easy money.

People usually think of Federal Reserve intervention as an emergency tool used only during economic downturns like the Great Financial Crisis of 2008 and the COVID pandemic. In reality, this easy money policy has been the status quo. Today, the money supply is increasing at a rate of $1 trillion per year, even when there isn’t a recession or crisis happening.

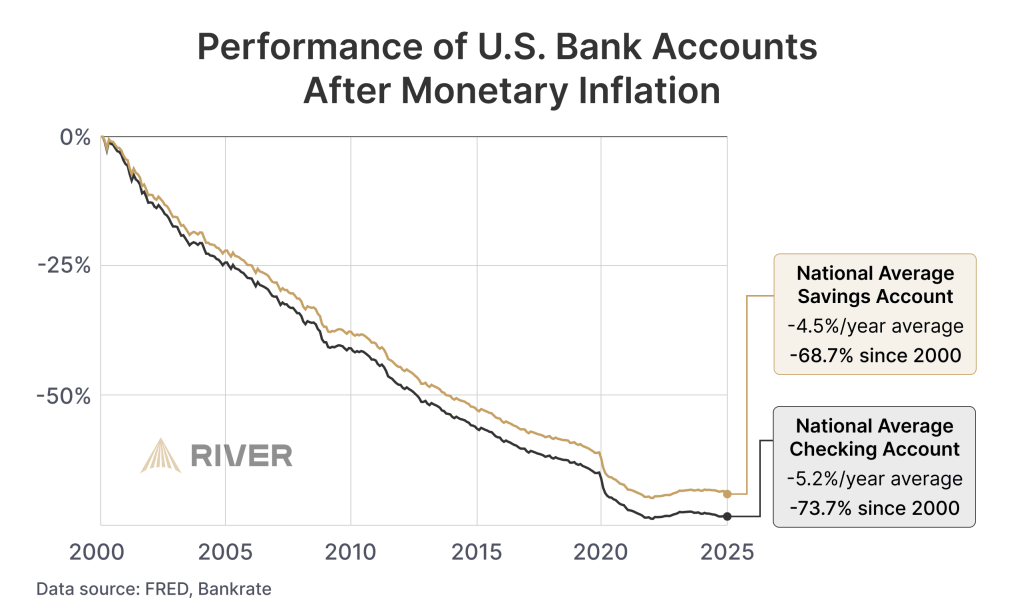

Every time the Federal Reserve engages in monetary stimulus, it makes our system more fragile. The cracks are starting to show in people’s savings, where the average bank account has been eroded by nearly 70% since 2000.

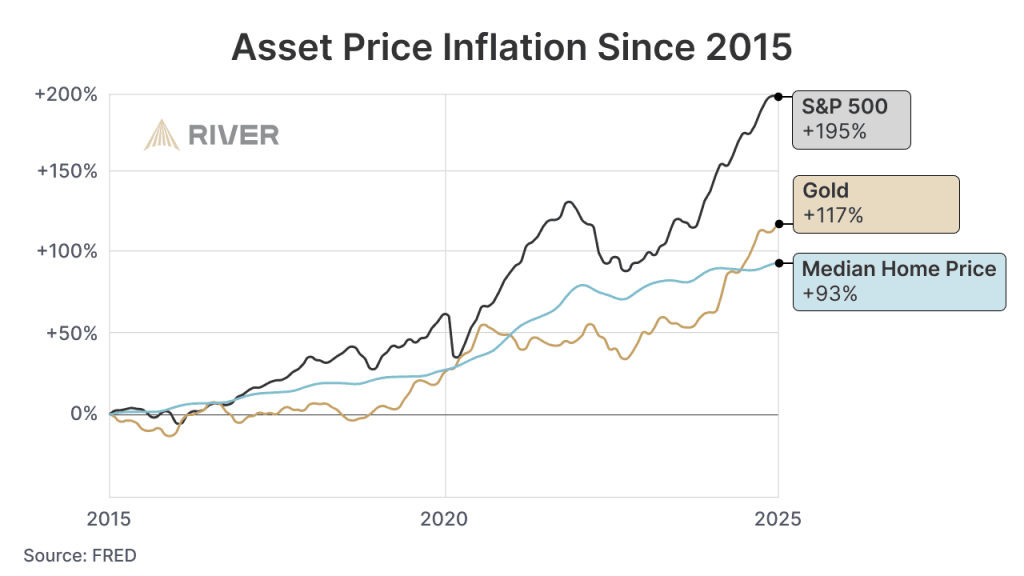

At the same time, everything becomes more expensive. What’s driving house and stock prices isn’t the economy, it’s money printing.

It’s impossible to know how long this will go on for, because politicians and bankers have no reason to change a system that works for them.

But you can change your own future; take back control, save, rebuild, and uplift others.

You must be logged in to post a comment.